PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on November 3, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Schedule 14A

___________________

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed by the Registrant | ☑ | |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☑ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

AMAZE HOLDINGS,

INC.

(Name of Registrant as Specified In Its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

[ ], 2025

Dear Stockholders:

You are cordially invited to join us for our special meeting of stockholders, which will be held virtually on Wednesday, December 10, 2025, at 11:00 a.m., Eastern Time. The virtual meeting can be accessed by visiting meetnow.global/MWM9RXL.

The notice of the special meeting of stockholders and the proxy statement that follow describe the business to be conducted at the meeting. Whether or not you plan to attend the virtual meeting, your vote is important and we encourage you to submit your proxy to vote your shares promptly. You may vote your shares by proxy by using a toll-free telephone number, the internet, or mail, free of charge. Instructions regarding these three methods of voting are contained in the proxy materials.

We look forward to having you attend the virtual meeting.

Sincerely,

Aaron Day

Chairman and Chief Executive Officer

AMAZE HOLDINGS, INC.

2901 West Coast Highway, Suite 200

Newport Beach, CA 92663

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 10, 2025

|

TO THE STOCKHOLDERS OF AMAZE HOLDINGS, INC.: NOTICE IS HEREBY GIVEN that a special meeting of stockholders of Amaze Holdings, Inc. will be held on December 10, 2025, at 11:00 a.m., Eastern Time, or at any adjournment or postponement thereof. The special meeting will be a virtual meeting only, and will be online via audio-only webcast at meetnow.global/MWM9RXL. The purpose of the special meeting will be to consider and vote upon the following proposals:

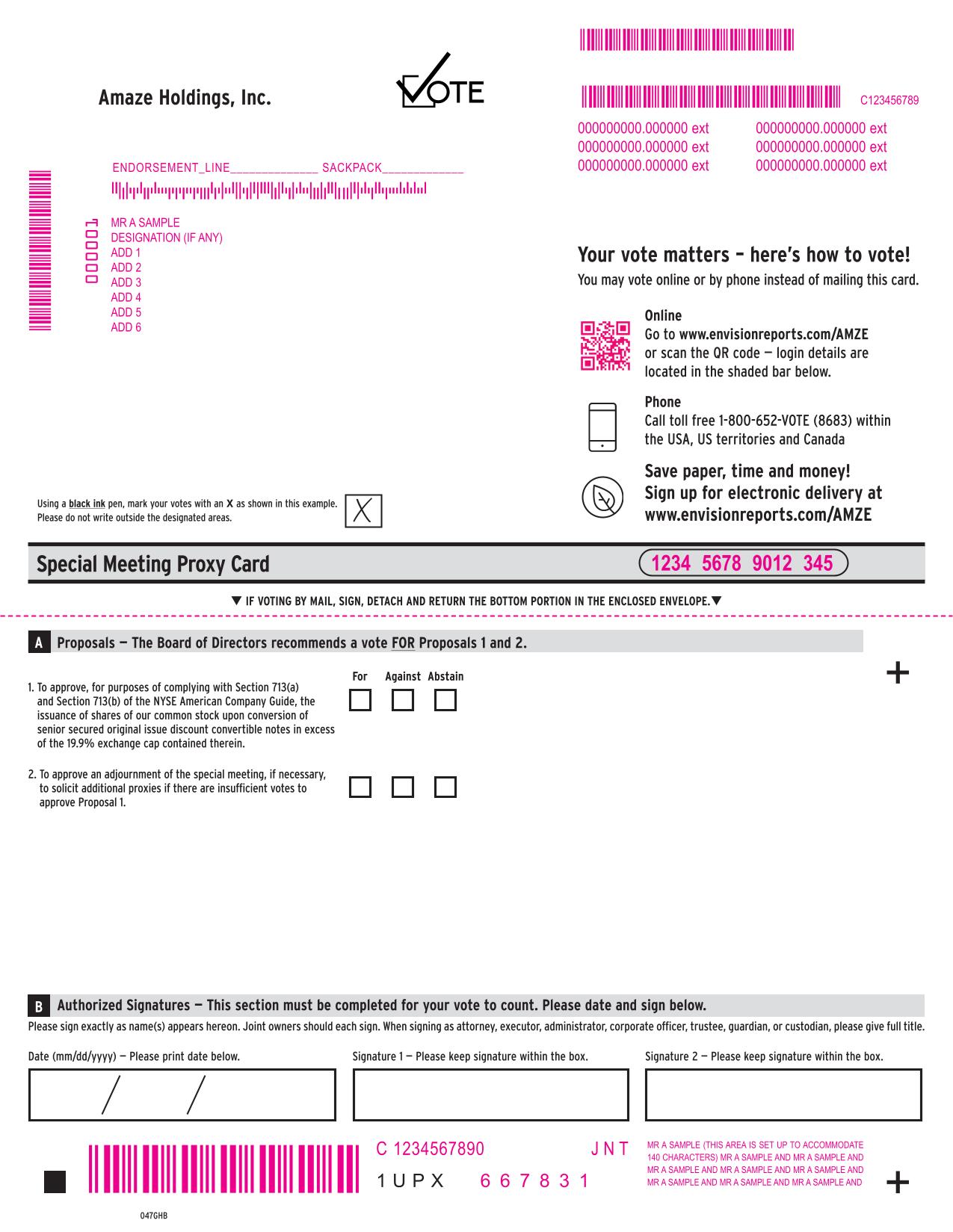

1. To approve, for purposes of complying with Section 713(a) and Section 713(b) of the NYSE American Company Guide, the issuance of shares of our common stock upon conversion of senior secured original issue discount convertible notes in excess of the 19.9% exchange cap contained therein; and

2. To approve an adjournment of the special meeting, if necessary, to solicit additional proxies if there are insufficient votes to approve Proposal 1.

These items of business are more fully described in the proxy statement accompanying this Notice. The record date for the special meeting is November 7, 2025. Only stockholders of record at the close of business on that date may vote at the special meeting or any adjournment or postponement thereof. By Order of the Board of Directors

Aaron Day Chief Executive Officer [•], 2025 |

Your vote is important. Whether or not you attend the special meeting, it is important that your shares be represented. You may vote your proxy through the Internet, by phone or by mail by completing and returning the proxy card mailed to you. Voting instructions are printed on your proxy card and included in the proxy statement.

|

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held Virtually at 11:00 a.m., Eastern time on December 10, 2025. The proxy statement is available at www.envisionreports.com/AMZE.

|

AMAZE HOLDINGS, INC.

2901 West Coast Highway, Suite 200

Newport Beach, California 92663

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held on December 10, 2025

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

These proxy materials are being furnished in connection with the solicitation of proxies by the board of directors (the “Board of Directors” or the “Board”) of Amaze Holdings, Inc. for use in connection with the special meeting of stockholders to be held exclusively online via audio-only webcast at meetnow.global/MWM9RXL on Wednesday, December 10, 2025, at 11:00 a.m., prevailing Eastern time, and at any adjournments or postponements of the special meeting.

Except where the context otherwise requires, references to “Amaze,” “the Company,” “we,” “us,” “our” and similar terms refer to Amaze Holdings, Inc. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share (“Common Stock”), our Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), our Series B Convertible Preferred Stock, par value $0.001 per share ( “Series B Preferred Stock”), and our Series C Convertible Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”). The Series A Preferred Stock, Series B Preferred Stock, and Series C Preferred Stock are collectively referred to herein as the “Preferred Stock.”

This proxy statement summarizes information about the proposals to be considered at the special meeting. The proxy card is a means by which you actually authorize the proxies to vote your shares in accordance with your instructions.

Why am I receiving these proxy materials?

We are providing you with these proxy materials because the Board is soliciting your proxy to vote at the special meeting of stockholders, including at any adjournments or postponements thereof.

We are mailing this proxy statement and accompanying proxy card on or about [•], 2025, to all stockholders of record as of the close of business on November 7, 2025.

How do I attend the special meeting?

The special meeting will be a virtual meeting. There will be no physical meeting location and the special meeting will be conducted online. Any stockholder can attend the virtual special meeting live by accessing meetnow.global/MWM9RXL. The special meeting will start at 11:00 a.m., Eastern time, on Wednesday, December 10, 2025.

To access the special meeting, you will need the control number, which is included on your proxy card if you are a stockholder of record, or included with your voting instruction card and voting instructions received from your broker, bank or other agent if you hold your shares in a “street name.” We recommend that you log in a few minutes before 11:00 a.m., Eastern Time to ensure you are logged in when the special meeting starts. The webcast will open 15 minutes before the start of the special meeting.

You may submit questions prior to the special meeting by visiting meetnow.global/MWM9RXL and entering a valid control number, and then following the instructions to submit a question.

We ask that you limit your questions to those that are relevant to the special meeting. Questions may not be addressed if they are, among other things, profane, irrelevant to our business, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political or business interests.

| 1 |

What if I have trouble accessing the special meeting?

If you have technical difficulties logging into the special meeting or while in attendance, you can use the technical resources available on the log-in page at meetnow.global/MWM9RXL, which will be available beginning at 8:30 a.m. Eastern Time on December 10, 2025 or contact 1-888-724-2416 for further assistance.

Who can vote at the special meeting?

The Board of Directors has fixed November 7, 2025 as the record date for the determination of stockholders entitled to notice of, and to vote at, the special meeting and any adjournment or postponement thereof. Only stockholders of record, including holders of our Common Stock and Preferred Stock, at the close of business on the record date are entitled to notice of, and to vote at, the special meeting. At the close of business on the record date, there were [•] shares of Common Stock, [4,500] shares of Series A Preferred Stock, [5,250] shares of Series B Preferred Stock, and [8,550] shares of Series C Preferred Stock issued and outstanding.

Each share of our Common Stock entitles the holder thereof to one vote on each matter submitted for stockholder approval.

The holders of our Preferred Stock are entitled to vote as a single class with the holders of our Common Stock on all matters submitted to a vote of stockholders. The shares of Preferred Stock vote on an as-converted to common stock basis (as described below). As of the record date, our Common Stock and each series of our Preferred Stock (on an as-converted basis) have the following total number of votes:

| Class of Stock | Outstanding Shares | Total Number of Votes |

| Common Stock | [•] | [•] votes |

| Series A Preferred Stock | [•] | [•] votes |

| Series B Preferred Stock | [•] | [•] votes |

| Series C Preferred Stock | [•] | [•] votes |

For purposes of determining voting rights of Series A Preferred Stock, each share of Series A Preferred Stock is convertible into the number of shares of common stock calculated by dividing the stated value of $100.00 (plus the amount of accrued dividends on such shares of Series A Preferred Stock) by an assumed conversion price equal to the most recent closing sale price of our common stock as of the execution and delivery of the securities purchase agreement.

For purposes of determining voting rights of Series B Preferred Stock, each share of our Series B Preferred Stock is convertible into the number of shares of common stock calculated by dividing the stated value of $100.00 by an assumed conversion price equal to the most recent closing sale price of our Common Stock as of the execution and delivery of the securities purchase agreement pursuant to which such share of Series B Preferred Stock was issued by us.

For purposes of determining voting rights of Series C Preferred Stock, each share of Series C Preferred Stock will have such number of votes as is determined in accordance with the Certificate of Designation related thereto. For purposes of determining voting rights, each share of our Series C Preferred Stock is convertible into the number of shares of common stock calculated by dividing the stated value of $100.00 by an assumed conversion price equal to the most recent closing sale price of our common stock as of the date of execution and delivery of the securities purchase agreement pursuant to which such share of Series C Preferred Stock was issued by us.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholder of Record

If your shares were registered directly in your name with our transfer agent, Computershare (or registered directly in your name on the books and records of the Company with respect to the Series A Preferred Stock, Series B Preferred Stock or Series C Preferred Stock), then you are a stockholder of record. As a stockholder of record, you may vote at the special meeting or vote by proxy prior to the special meeting. Whether or not you plan to attend the special meeting, we urge you to vote by proxy through the Internet, by phone or using a proxy card to ensure your vote is counted.

| 2 |

Beneficial Owner

If your shares were not registered in your name, but instead are held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in “street name” and proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the special meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You must follow the instructions provided by your broker, bank, or other similar organization for your bank, broker or other stockholder of record to vote your shares per your instructions. Since you are not the stockholder of record, however, you may not vote your shares at the special meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

You may vote on the following 2 items at the special meeting:

| 1. | To approve, for purposes of complying with Section 713(a) and Section 713(b) of the NYSE American Company Guide, the issuance of shares of our Common Stock upon conversion of senior secured original issue discount convertible notes in excess of the 19.9% exchange cap contained therein (Proposal 1); | |

| 2. | To approve an adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1 (Proposal 2). |

How does our Board of Directors recommend that I vote?

Our Board of Directors has determined and believes that each of the proposals outlined above is advisable to, and in the best interests of, the Company and its stockholders and has approved each such proposal. The Board of Directors unanimously recommends that stockholders vote “FOR” each proposal.

In connection with the issuance of the senior secured original issue discount convertible notes, we agreed to use our reasonable best efforts to solicit stockholder approval of Proposal 1 and to cause our Board of Directors to recommend to our stockholders that they approve Proposal 1.

How do I vote?

The answer depends on whether you own your shares directly in your name or if your shares are held in an account at a brokerage firm, bank, or similar organization.

Stockholder of Record — Shares Registered in Your Name: If you are a stockholder of record, you may vote online during the special meeting, vote by proxy using the enclosed proxy card, or vote by proxy via telephone or the Internet. Whether or not you plan to attend the special meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote online during the special meeting even if you have already voted by proxy.

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the special meeting, we will vote your shares as you direct. | |

| • | To vote online during the special meeting, follow the provided instructions to join the meeting at meetnow.global/MDLZW4V starting at 11:00 a.m., Eastern Time on Wednesday, December 10, 2025. The webcast will open 15 minutes before the start of the meeting. | |

| • | To vote over the telephone, call 1-800-652-VOTE (8683) until 1:00 a.m. Eastern Time on December 9, 2025. Have your proxy card in hand when you place your call and follow the instructions to vote your shares. | |

| • | To vote through the internet prior to the special meeting, go to www.envisionreports.com/AMZE to complete an electronic proxy card. You will be asked to provide the control number from the proxy card. Your internet vote must be received by 11:59 P.M., Eastern Time on December 9, 2025 to be counted. |

Beneficial Owner — Shares Registered in the Name of a Broker or Bank: If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should receive a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is submitted to your broker or bank. Alternatively, you may be able to vote over the Internet or by telephone as instructed by your broker or bank. To vote at the special meeting, you must obtain a valid legal proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

| 3 |

We provide Internet and telephone proxy voting to allow you to vote your shares online or by telephone, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet or telephone access, such as usage charges from Internet or telephone access providers.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, through the Internet or by voting electronically at the special meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted as follows:

| • | FOR Proposal 1 - approval, for purposes of complying with Section 713(a) and Section 713(b) of the NYSE American Company Guide, of the issuance of shares of our Common Stock upon conversion of senior secured original issue discount convertible notes in excess of the 19.9% exchange cap contained therein; and | |

| • | FOR Proposal 2 - approval of an adjournment of the special meeting, if necessary, to solicit additional proxies if there are insufficient votes in favor of Proposal 1; |

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the NYSE American, brokers, banks and other securities intermediaries that are subject to NYSE American rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE American rules, but not with respect to “non-routine” matters.

Proposals 1 and 2 are considered to be “non-routine” under NYSE American rules. Accordingly, if any of your shares are held by brokers, banks or other nominees and you have not provided instructions for the voting of those shares with respect to any of the proposals, your shares will not count as votes for or against the proposal.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE American rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” Proposals 1 and 2 are considered to be “non-routine” under applicable stock exchange rules and, therefore, we expect broker non-votes to exist in connection with such proposals.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

| 4 |

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the special meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date (which automatically revokes the earlier proxy). | |

| • | If you have voted by telephone or Internet, you may cast a new vote by telephone or over the Internet as instructed above. | |

| • | You may send a timely written notice that you are revoking your proxy to our Secretary at our principal executive offices at 2901 West Coast Highway, Suite 200, Newport Beach, CA 92663. | |

| • | You may attend the special meeting and vote online during the meeting. Attending the meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How many votes are needed to approve each proposal?

Proposal 1: “For” votes from the holders of stock having a majority of the voting power present in person or represented by proxy and entitled to vote on the matter. Broker non-votes will not affect the outcome. Abstentions will have the same effect as a vote “against” Proposal 1.

Proposal 2: “For” votes from the holders of stock having a majority of the voting power present in person or represented by proxy and entitled to vote on the matter. Broker non-votes will not affect the outcome. Abstentions will have the same effect as a vote “against” Proposal 2.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote are deemed present at the special meeting in person or represented by proxy. On the record date, there were [•] shares of Common Stock outstanding and entitled to vote, [4,500] shares of Series A Preferred Stock outstanding, which are convertible into [•] voting shares of Common Stock and entitled to vote, [5,250] shares of Series B Preferred Stock outstanding, which are convertible into [•] voting shares of Common Stock and entitled to vote, and [8,550] shares of Series C Preferred Stock outstanding, which are convertible into [•] voting shares of Common Stock and entitled to vote. Thus, the holders of shares entitled to [•] votes must be deemed present in person or represented by proxy at the special meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote electronically at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of the voting power of shares deemed present at the special meeting in person or represented by proxy may adjourn the special meeting to another date.

How can I find out the results of the voting at the special meeting?

Preliminary voting results will be announced at the special meeting. In addition, final voting results will be reported in a Current Report on Form 8-K that we expect to file with the Securities and Exchange Commission within four business days after the special meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to report preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to report the final results.

| 5 |

PROPOSAL 1

Approval, for purposes of complying with Section 713(a) and SEction 713(b) of the NYSE American Company Guide, OF the issuance of shares of our Common Stock upon conversion of senior secured original issue discount convertible notes

General

On September 11, 2025, we entered into a securities purchase agreement (the “Purchase Agreement”) with certain holders of our secured original issue discount notes (the “Prior Notes”). Under the terms of the Purchase Agreement, the investors agreed to purchase approximately $4,143,234 in aggregate principal amount of senior secured original issue discount convertible promissory notes (the “New Senior Secured Convertible Notes”) for a total consideration of $4,043,234.24 by (i) exchanging approximately $3,043,234 of aggregate outstanding principal amount, plus accrued interest, of Prior Notes held by them and (ii) paying $1,000,000 in cash to us.

Under the terms of the Purchase Agreement, we agreed not to effect or enter into any agreement to effect any issuance of Common Stock or Common Stock Equivalents involving a Variable Rate Transaction (as defined in the Purchase Agreement), for so long as any investor holds any New Senior Secured Convertible Notes. In addition, if, any time until the New Senior Secured Convertible Notes are no longer outstanding, we propose to sell securities in a subsequent financing, each investor may elect, in its sole discretion, to exchange all or a portion of such investor’s New Senior Secured Convertible Note for securities of the same type issued in such subsequent financing, based on 110% the principal amount of the New Senior Secured Convertible Note then outstanding.

We agreed to use our reasonable best efforts to solicit such stockholder approval as may be required under the NYSE American Company Guide with respect to the transactions contemplated by the Purchase Agreement and the New Senior Secured Convertible Notes, including the issuance of shares of Common Stock upon conversion of the New Senior Secured Convertible Note in excess of 19.9% of the issued and outstanding Common Stock on the closing date, and to cause our Board of Directors to recommend that stockholders approve such proposal at the stockholder meeting. We also agreed to use best efforts to seek to obtain such stockholder approval no later than the 90th date from the date of the Purchase Agreement. If such stockholder approval is not obtained, we are required to hold another stockholder meeting every 90 days until stockholder approval is obtained.

New Senior Secured Convertible Notes

The following summary of the terms of the New Senior Secured Convertible Notes is not complete and is subject to and qualified in its entirety by the provisions of the New Senior Secured Convertible Note, which was filed as an exhibit to the Current Report on Form 8-K filed with the SEC on September 17, 2025.

The New Senior Secured Convertible Notes are our senior secured obligations and will mature on March 11, 2026 unless earlier converted. The New Senior Secured Convertible Notes bear interest at an annual rate of 7%, payable on the first trading day each month. We may extend the maturity date for six months, upon which the principal and accrued and unpaid interest will be increased to 110% of the total principal and all accrued and unpaid interest as of the original maturity date. The New Senior Secured Convertible Notes have an initial conversion price of $2.33 per share, subject to adjustment for subsequent lower price issuances or deemed issuances by us as well as stock splits, combinations, stock dividends and reclassifications. The New Senior Secured Convertible Notes are convertible at any time after the issuance date. If we receive a conversion notice at a time when the conversion price is less than the floor price, we will issue a number of shares equal to the conversion amount divided by the floor price and pay the economic difference between the applicable conversion price (without regard to the floor price) and such floor price in cash. The floor price is $1.50, subject to adjustment for stock splits, combinations, stock dividends and reclassifications.

In order to comply with NYSE American Company Guide, the New Senior Secured Convertible Notes provide that, prior to the date that stockholder approval has been obtained, conversion of the New Senior Secured Convertible Notes among the holders is limited in the aggregate to 19.9% of our outstanding Common Stock as of the date of the Purchase Agreement. The New Senior Secured Convertible Notes contain a 9.99% maximum beneficial ownership limitation, and customary provisions regarding events of defaults and negative covenants.

| 6 |

Under the New Senior Secured Convertible Notes, the investors have the right to participate in any subsequent financing (other than an at-the-market offering or equity line of credit) by exchanging a portion of such investor’s New Senior Secured Convertible Note representing on a pro rata basis of up to 100% of the securities or instruments being offered and sold in such financing, at a 20% discount. In addition, if while the New Senior Secured Convertible Note is outstanding, we receive cash proceeds from any financing, we are required to prepay the principal and accrued and unpaid interest thereon within one trading day thereof, in an amount equal to the investor’s pro rata portion of 30% of the net proceeds received by us in such financing. However, such prepayment will not apply to (i) the first $1,500,000 of net proceeds received by us after September 11, 2025 pursuant to the Securities Purchase Agreement dated May 6, 2025 between the Company and C/M Capital Master Fund, LP, (ii) the proceeds received under the Securities Purchase Agreement dated August 7, 2025 between the Company and Parler Cloud Technologies, LLC and (iii) the first $2,500,000 of net proceeds received by us in an at-the-market offering (the “Continuing Offering Thresholds”). If the closing price of our Common Stock falls below 50% of the floor price, then the Continuing Offering Thresholds will cease to apply and the prepayment amount will increase to 50% from 30% of the net proceeds.

Reason for Proposal

Because our Common Stock is listed on the NYSE American, we are subject to NYSE American’s rules and regulations. NYSE American Company Guide Section 713(a) requires a company listed on the NYSE American to obtain stockholder approval prior to the issuance of common stock (or other securities convertible into common stock) when the additional shares will be issued in connection with a transaction, other than a public offering, involving the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of the company’s outstanding stock for less than the greater of book or market value of the stock. NYSE American Company Guide Section 713(b) requires a company listed on the NYSE American to obtain stockholder approval prior to an issuance of securities that will result in a “change of control” of the company. Although NYSE American has not adopted any rule as to what constitutes a “change of control,” a change of control may be deemed to occur when an investor or investor group acquires or has the right to acquire 20% or more of a company’s outstanding common stock or voting power and such ownership or voting power would be the largest ownership position. A “change of control” under NYSE American Company Guide Section 713(b) applies only with respect to the application of such rule and does not constitute a “change of control” for purposes of Nevada law, our organizational documents or any other purpose.

Based on the initial conversion price of $2.33 per share and disregarding the 9.9% beneficial ownership limitation, the total number of shares of Common Stock issuable upon conversion of $4,143,234 in aggregate principal amount of the New Senior Secured Convertible Notes would be 1,778,212 shares (without taking into account accrued interest), which would represent approximately 21.7% of our outstanding Common Stock on September 11, 2025. However, if the conversion price in effect at the time of conversion is less than the floor price of $1.50 share, based on the floor price, the total number of shares issuable upon conversion of the New Senior Secured Convertible Notes would be 2,762,156 shares (without taking into account accrued interest), which would represent approximately 30.2% of our outstanding Common Stock on September 11, 2025. Therefore, the stockholder approval requirements under NYSE American Company Guide Sections 713(a) and (b) apply to the issuance of the Common Stock upon conversion of New Senior Secured Convertible Notes.

Stockholder approval of Proposal 1 will constitute stockholder approval for purposes of NYSE American Company Guide Sections 713(a) and (b).

Potential Effects of Proposal 1

If Proposal 1 is approved, the issuance of shares of our Common Stock upon conversion of the New Senior Secured Convertible Notes would result in an increase in the number of shares of our Common Stock outstanding, and our existing stockholders will suffer significant dilution in their ownership interests. As discussed above, the number of shares issuable upon conversion of the New Senior Secured Convertible Notes would substantially increase if the initial conversion price is adjusted lower. The number of shares that will actually be issued on conversion of the New Senior Secured Convertible Notes depends on a number of factors, including the total principal amount and amount of accrued interest that is being converted, and whether the conversion price has been adjusted lower for dilutive issuances by us.

In the event that our stockholders do not approve this Proposal 1, conversion of the New Senior Secured Convertible Notes will continue to be limited in the aggregate to 19.9% of our outstanding Common Stock as of the date of the Purchase Agreement.

| 7 |

Interest of Directors and Executive Officers

None of our directors or executive officers has any substantial interest, direct or indirect, in the approval of this Proposal 1.

Vote Required for Approval

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote will be required for approval of Proposal 1.

Recommendation of Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL 1.

| 8 |

PROPOSAL 2

Approval of AN Adjournment of the special meeting, if necessary, to solicit additional proxies IF THERE ARE INSUFFICIENT VOTES TO APPROVE PROPOSAL 1

Our Board believes that if there are insufficient votes at the special meeting to approve Proposal 1, it may be in the best interests of the stockholders to enable our Board to continue to seek to obtain a sufficient number of additional votes.

We are asking stockholders to authorize the holder of any proxy solicited by our Board to vote in favor of adjourning the special meeting or any adjournment or postponement thereof. If our stockholders approve this proposal, we could adjourn the special meeting, and any adjourned session of the special meeting, to use the additional time to solicit additional proxies in favor of Proposal 1, as described in this proxy statement.

Additionally, approval of Proposal 2 could mean that, in the event we have not received sufficient votes to adopt and approve Proposal 1, or we have received proxies indicating that a majority of the votes to be cast by holders of our Common Stock will vote against Proposal 1, we could adjourn the special meeting without a vote on such proposal and use the additional time to solicit the holders of those shares to change their vote in favor of such proposal.

Vote Required

The affirmative vote of the holders of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote on the matter is required for approval of Proposal 2.

Recommendation of Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL 2.

| 9 |

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our Common Stock, Series A Preferred Stock, Series B Preferred Stock, and Series C Preferred Stock as of October 31, 2025 for (a) each person, or group of affiliated persons, known by us to own beneficially more than 5% of our outstanding shares of Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, (b) each of our directors, (c) each of our named executive officers, and (d) all of our directors and executive officers as a group.

Beneficial ownership is determined in accordance with SEC rules. In general, under these rules a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has or shares voting power or investment power with respect to such security. A person is also deemed to be a beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days, taking into account any conversion restrictions, including the 19.9% exchange cap and beneficial ownership limitation. To our knowledge, except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all common stock beneficially owned by that person.

The percentage of beneficial ownership shown in the table is based on 6,888,043 shares of Common Stock, 4,500 shares of Series A Preferred Stock, 5,250 shares of Series B Preferred Stock, and 8,550 shares of Series C Preferred Stock outstanding as of October 31, 2025.

Except as otherwise noted below, the address for each person or entity listed in the table is c/o Amaze Holdings, Inc., 2901 West Coast Highway, Newport Beach, CA 92663.

| Common Stock | Series A Preferred Stock | Series B Preferred Stock | Series C Preferred Stock | |||||

| Name of Beneficial Owner |

Number of Shares |

Percent |

Number of Shares |

Percent |

Number of Shares |

Percent |

Number of Shares |

Percent |

| Executive Officers and Directors | ||||||||

| Michael D. Pruitt | 1,306 | * | -- | -- | -- | -- | -- | -- |

| Keith Johnson | -- | -- | -- | -- | -- | -- | -- | -- |

| Eric Doan | 1,305 | * | -- | -- | -- | -- | -- | -- |

| Brad Yacullo | 1,305 | * | -- | -- | -- | -- | -- | -- |

| David Yacullo | 1,305 | * | -- | -- | -- | -- | -- | -- |

| Aaron Day(1) | 242,593 | 3.52% | -- | -- | -- | -- | -- | -- |

| Peter Deutschman | 67,978 | * | -- | -- | -- | -- | -- | -- |

| Amrapali Gan | -- | -- | -- | -- | -- | -- | -- | -- |

| Sandra Hawkins | -- | -- | -- | -- | -- | -- | -- | -- |

| Directors, nominees and executive officers as a group (10 people) | 315,791 | 4.58% | 0 | 0% | 0 | 0% | 0 | 0% |

| 5% Stockholders | ||||||||

| Blue Hawk, LLC(2) | 510,979 | 7.42% | -- | -- | -- | -- | -- | -- |

| RMD Holdings GMBH(3) | 372,294 | 5.33% | -- | -- | -- | -- | -- | -- |

| Thomas Frame(4) | 769,381 | 10.55% | -- | -- | -- | -- | -- | -- |

____

* Less than 1%

| (1) | Includes 5,924 shares held by the Day Family Trust dated August 20, 2020, of which Aaron E. Day and Elizabeth B. Day serve as trustees. | |

| (2) | According to Schedule 13G filed on October 7, 2025, Jerry Murdock is the sole member and manager of Blue Hawk, LLC. The address of Blue Hawk is P.O. Box 1268, Aspen, CO 81612. | |

| (3) | Includes 99,370 shares of Common Stock issuable upon exercise of warrants issued in March 2025. | |

| (4) | Includes 79,283 shares of common stock issuable upon exercise of warrants issued in March 2025, 249,021 shares of common stock issuable upon conversion of the amended and restated convertible promissory notes issued in August 2025, and 75,000 shares of common stock issuable upon exercise of the warrant issued in August 2025. |

| 10 |

HOUSEHOLDING OF MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement may have been sent to multiple stockholders in each household unless otherwise instructed by such stockholders. We will deliver promptly a separate copy of the proxy statement to any Company stockholder upon written or oral request to our Corporate Secretary, at Amaze Holdings, Inc., 2901 West Coast Highway, Suite 200, Newport Beach, CA 92663, telephone: 888-672-0365. Any stockholder wishing to receive separate copies of our proxy statement in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank, broker, or other nominee record holder, or the stockholder may contact us at the above address and phone number.

OTHER MATTERS

The Board of Directors does not know of any matters that may be presented at the special meeting. If other matters properly come before the special meeting, it is the intent of the persons named in the enclosed proxy to vote the proxy in accordance with their best judgment.

By Order of the Board of Directors

/s/ Aaron Day

Aaron Day

Chairman and Chief Executive Officer

11